Ten macroeconomic points to keep in mind this week

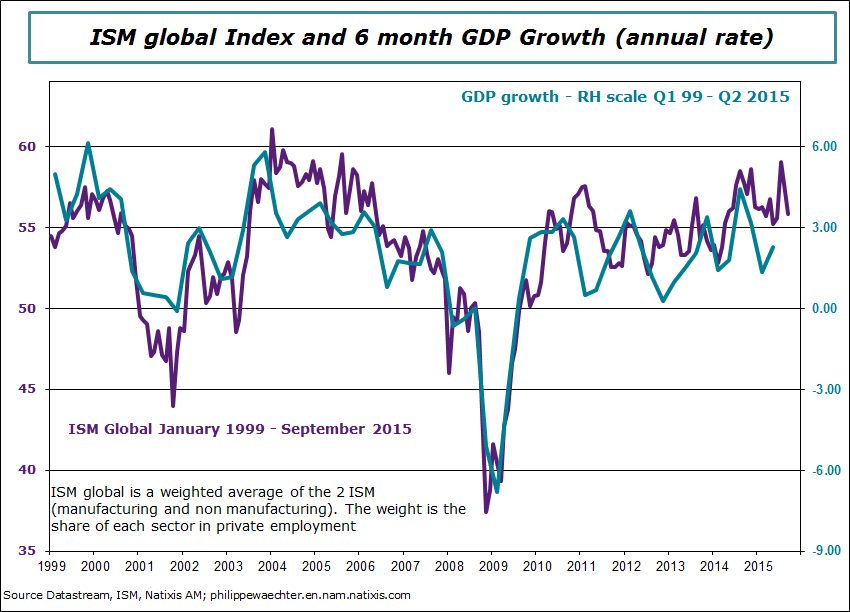

1 – The IMF has revised on the downside its forecast. In 2015 the world GDP will grow by 3.1% after 3.4% in 2014. Expectations for 2016 are marginally higher at 3.6%.

The main reason is in emerging countries which suffer with low commodity prices and the persistent weaker dynamics seen in China. The other point of concern is associated with higher Fed’s rates in the US. We feel a worried environment at this meeting

2 – The signature of the Trans-Pacific Partnership (or TPP) between the USA and 11 Asian partners (without China) is important. It is supposed to boost trade between all these members but we don’t know exactly what will happen in the balance of strength in this new framework. The arbitrage in case of conflict will be done by the World Trade Organization but we know that the role of states and companies will be different. This could be directly seen on the labor market conditions. As negotiations have been secret we need more details to clearly see the global picture and we will see with the experience how this TPP will work.

The agreement was a target for the current US administration and for Asian countries it’s a way to improve their relationship with the US in a period during which Chinese momentum is weaker. All these countries that became dependent on the Chinese dynamics can expect an improvement of their trade.

3 – From central banks’ minutes we perceived that the global situation is not strong yet. The postponement of the convergence of inflation to their target of 2% and the limited growth momentum they perceive are a source of concern. They prefer waiting instead of acting in a too early manner.

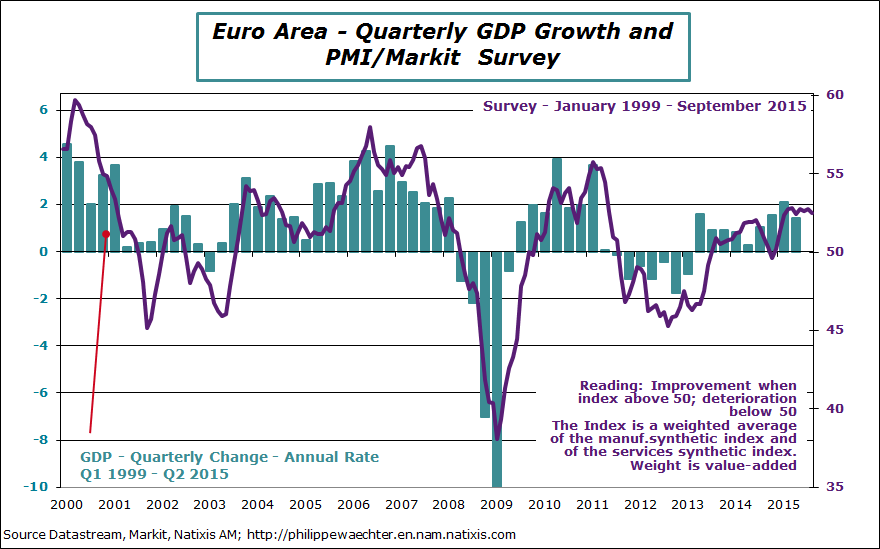

4 – The Markit synthetic index for the Euro Area has been revised on the downside but its level is still in the corridor seen since last February. Growth will be positive in 2015, there is no ambiguity, but it doesn’t accelerate. Countries’ business cycles are still too heterogeneous.

The economic momentum is may be more fragile than expected. That’s what this figures say and it could a source of the prudent ECB behavior.

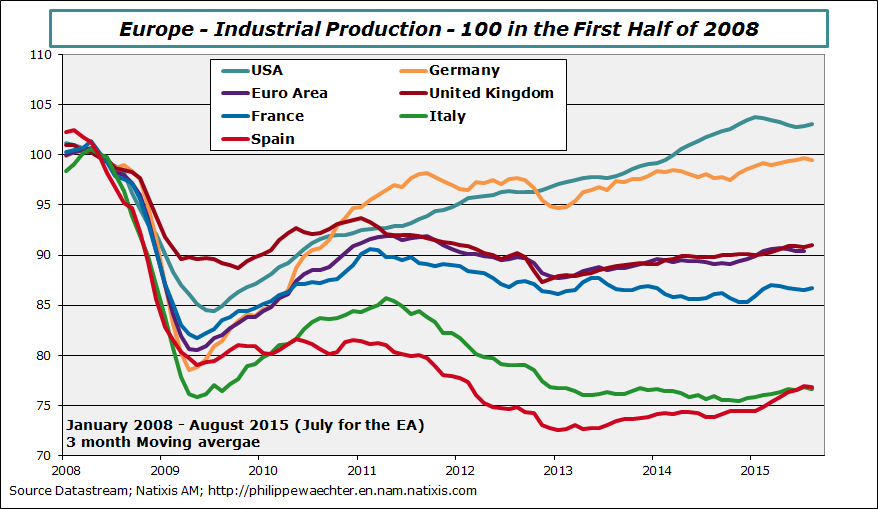

We see on the graph that in recent months Spain has converged to Italy.

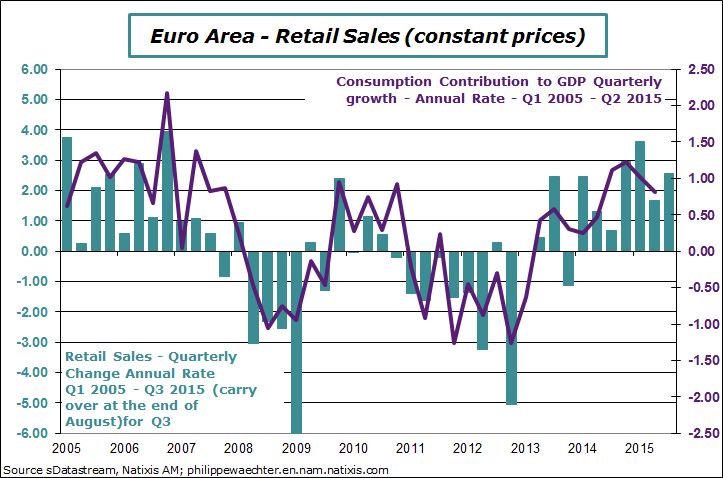

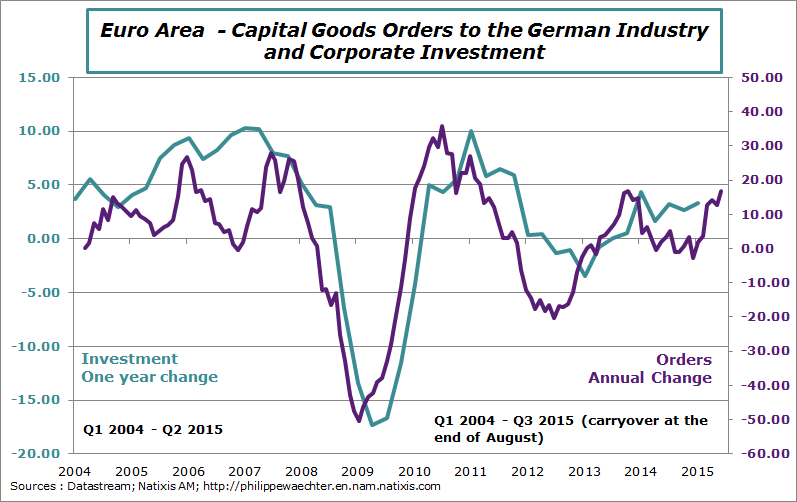

In other words, internal demand (households’ expenditures + investment) could be the source of a higher growth momentum in 2016 in the Euro Area. This will not be a catalyst for an ECB move. The Euro Area central banker has still a lot of time.

The German exports ‘ drop in August is not yet an issue of concern.

On Tuesday the ZEW will give a first highlight in Germany and on Thursday the Fed of New York and of Philadelphia will do the same for the US. Next Friday the industrial production for the US in September will be announced and on Thursday it is the production index for August in the Euro Area that will be published.

Wednesday, retail sales will be announced in the US. It will give us a better perception of the third quarter momentum on consumption. In the United Kingdom, employment figures for August (employment) and September (wages) will be published (Thursday).

In China, the trade balance will be announced on Tuesday and the inflation rate on Wednesday.

Inflation rate in the Euro Area (Friday), in France (Wednesday), in Germany (Tuesday), in Spain (Wednesday), in the UK (Tuesday) and in the US (Thursday) will be announced for September.

Have a good week

Philippe Waechter's blog My french blog