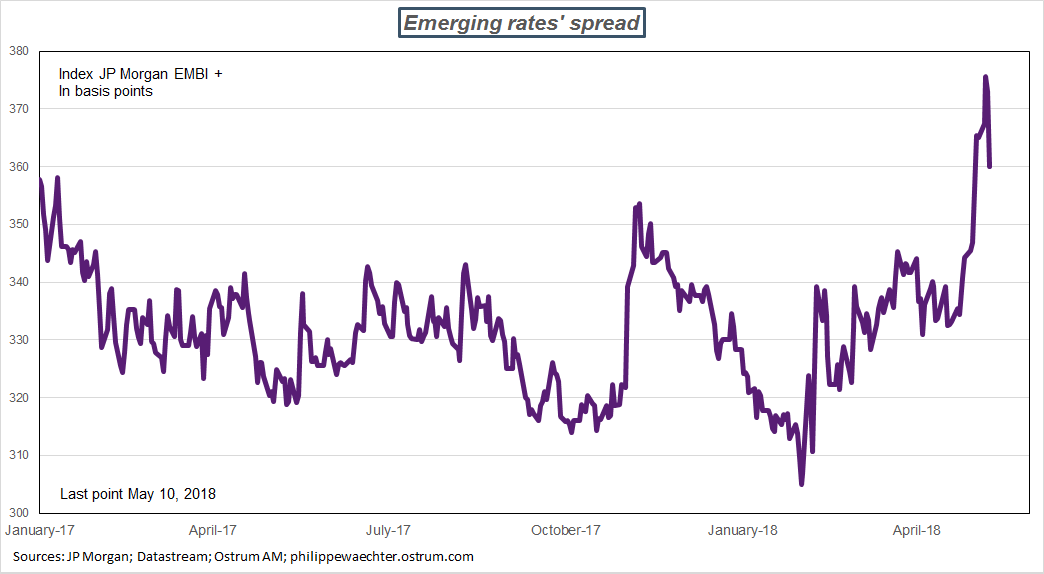

In a recent post I mentioned that the improvement in the greenback had an strong impact on emerging countries. Capital outflows and lower emerging currencies were mentioned as a source of concern. We have to add the interest rate spread that is now wider than it used to be. It was almost stable since the beginning of 2017 with an average spread close to 330 bp. This is no longer the case since mid-April with the change in the greenback profile.

Rules of the game are deeply changing for emerging countries even if every country is not hurt in the same way. Rules have changed, then be attentive

Philippe Waechter's blog My french blog