The US imposed steel (25%) and aluminum (10%) duties on Europe, Canada and Mexico on May 31, reflecting Trump’s obsession to bring business back to the US and contain the country’s external deficit. He had already presented this idea right from his inaugural address (in French) at the White House, with his view of the world economy as a zero-sum game, meaning each country has to fight tooth-and-nail to get its hands on the biggest slice of the pie. This view is admittedly not helpful in understanding economic and growth momentum, but it is the view we are dealing with here.

Based on steel and aluminum exports to the US, the cost for Canada is very high at around 2 billion, as well as for Mexico (600 million) and the European Union at around 1.7 billion, including close to 400 million for Germany and 150 million for France. These are substantial figures, so they can have an impact on trade with the US.

So in the end, who will come out the winner from this tariff jostling? It is probably a no-win situation. A trade war is a bit like going 15 rounds in heavyweight boxing match…the two fighters make it through, but they are both a mess by the end and run the serious risk of some long-lasting after-effects.

We can raise a number of points:

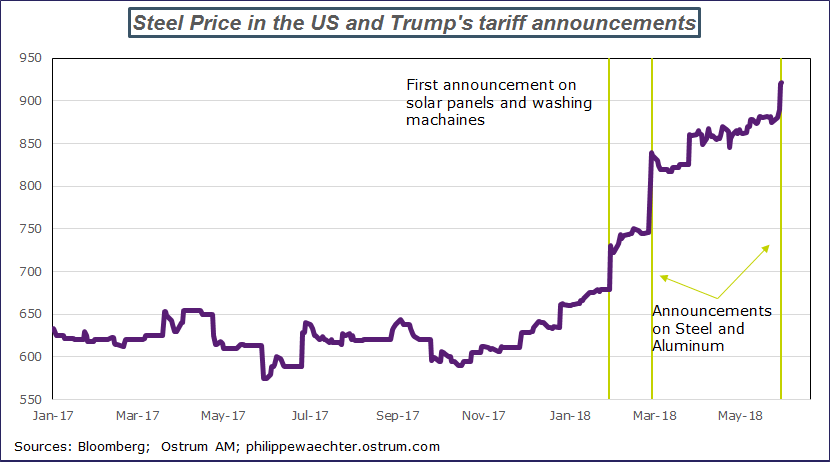

1 – Announcements made at the start of March and on Thursday May 31 pushed steel prices up, as shown very clearly by the chart below.

2 – This means that US companies in the steel sector are facing higher prices due to the White House’s tariffs. US companies are the first to suffer from Donald Trump’s economic policies and these higher prices will be passed onto downstream industries.

3 – Steel and aluminum are involved right at the start of the production chain, which means that the entire upstream production process is affected by rising prices.

4 – This price hike will have knock-on effects on in-store prices, which will subsequently hit household purchasing power. For example, it will heavily affect the cost of vehicle purchases and could wipe out a large proportion of the tax cut that US householders have previously enjoyed. According to the Washington Post, an American middle class household benefiting from a $900 tax cut could have to pay $500 more for a new car purchase. So the economic boost from the tax cut is significantly reduced.

5 – The issue also raises fresh questions on the pace of Trump’s overall economic policy. After economic stimulus via tax cuts and a hike to public spending, was it really necessary to make these moves on border duties with the ensuing stifling effect on the stimulus program?

6 – The steel sector is in a more comfortable position but the situation for downstream industries is more unsteady and it has been estimated than one job saved in the metal sector equates to five lost jobs in these downstream industries. Is it really worth it?

7 – President Bush had already implemented border duties on steel (20%) in 2002, and it was estimated at the time that this move led to the net destruction of 200,000 jobs. Border tariffs have a hefty impact and the US economy is set to lose out, even before we factor in any potential retaliatory measures from the country’s trade partners.

8 – The hit to prices is also a source of disruption for world trade as a whole as it changes decisions from the various players and potentially the location of production. The world economic situation is dependent on world trade, with the recovery in trade in late 2016 triggering the improvement in the economic environment we have seen throughout 2017 and still through to this day, so a long-lasting shock would be bad news.

9 – We can also see that trade momentum is fragile and can quickly change, as shown by the 2008 example. Announcements from the White House should act as warning bells that need to be closely monitored.

10 – This issue of world trade is particularly tricky as products are now made in a number of different countries. This affects the allocation of resources in the long term, so the grains of sand that Trump has thrown into the well-oiled cogs of world trade are poised to disrupt the current balance and lead to long and sometimes complex adjustments that could trigger uncertainty and dent trade and economic activity overall.

11 – We should expect retaliatory measures from Europe as the European Commission has already made clear: the US is not the only country that can make this sort of move. Some products have already been mentioned e.g. motorbikes (Harley Davidson), bourbon, Levi’s jeans, sodas and even peanut butter, with as much as 3 billion in taxes on US exports potentially involved.

12 – The first remark worth making is that retaliatory measures mean taking the risk of ending up in a situation of escalating one-upmanship that eventually leads to a series of restrictions where all sides lose out. It would be preferable to avoid the situation spiraling out of control in this way.

Looking back to my remarks in points 2-4, is retaliation really necessary? The US economy will itself be hit.

13 – A second point here is that part of the production that was being exported to the US may be rerouted to Europe as US demand declines, with the risk of upending the entire European market. European states must work together to address this situation.

14 – The third remark is that the steps Europe has taken on the tariff issue are smarter. US tariffs are on products involved in the early stages of the production process, and this affects the production process as a whole as well as industry jobs. Meanwhile, Europe has targeted consumer goods: a decline in bourbon consumption is not too serious and will have no impact on production performances in Europe, which is good news.

15 – The world has become non-cooperative during Trump’s administration. When the March 1 announcements were made, US partners Mexico and Canada were exempt from tariffs due to their NAFTA membership, so it came as quite a shock to Justin Trudeau on May 31 when it became clear that Canada wasn’t exempt after all. His forceful response on trade with the US reflects the extent of his surprise.

Meanwhile in Europe, the surprise came from the White House’s rationale for import duties, when it explained the move as a matter of national security. Yet I thought that the US and Europe were allies in a relationship stretching back far into the past.

16 – This tariff war is bad news: history shows us that similar past situations have often led to long-lasting shockwaves extending out across the economy and denting jobs, and in this respect it is worth remembering the disastrous effects of the Smoot-Hawley tariff act in 1930 in spreading the impact of the 1929 crash and ensuing depression to the rest of the world. And this is the most disturbing aspect of this whole affair: a failure to understand the mechanisms of the economy sets off imbalances that are both difficult and lengthy to address for all concerned. This is simply unacceptable.

Philippe Waechter's blog My french blog