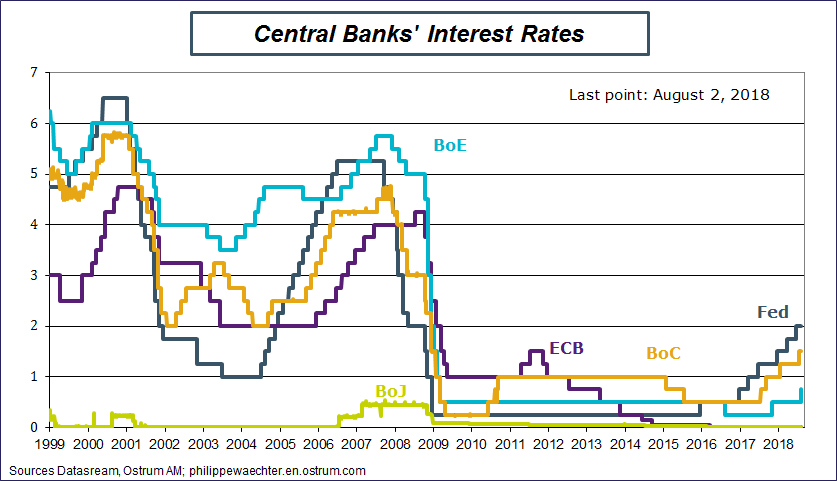

Central bankers are progressively adopting a pro-cyclical behavior. The global growth momentum is now lower and central banks’ strategy now have a restrictive bias. In the US, Canada, UK and in many emerging markets, central banks’ rates are higher than at the beginning of the year. This has already changed expectations and it will continue with a downside risk on the economic activity.

The 2017 recovery has been conditioned by a large and global monetary easing. The low inflation figures were an opportunity and this accommodation has boosted domestic demand in most countries pushing the world trade dynamics on the upside.

Now the global growth dynamics is weaker than last year and the restrictive monetary bias may have a negative impact on domestic demand and on world trade.

At the beginning of the year, forecasts for 2018 were usually close to 2017 realization. The main reason of this non acceleration was the absence of new impulse on monetary side but, except in the US, I didn’t anticipate this restrictive change.

This monetary bias is an important issue as in most developed countries, from the US to France, with the exception of Germany, the current growth trend is weaker than before 2007. The great recession has a persistent impact on growth and there is no convergence nor catch up to the previous trend. In other words, growth trends in developed countries are lower than before the great recession. The risk associated with this environment is on the inability to create good jobs on a large scale. Lower growth is associated with lower jobs dynamics except if jobs conditions are deteriorated. This is already a characteristic of many labor markets. Even with labor markets close or at the full employment level there is no upside pressure on wages. In the UK the deterioration on the labor market conditions was associated with the development of zero hour contracts, in France it was linked with very short contracts: 30% of short term contracts are one day contract (see here in French). It’s not a way to improve welfare.

This restrictive bias will not be compensated by more accommodative fiscal policies except in the US. So monetary constraints in a less dynamic global environment will hit the growth momentum.

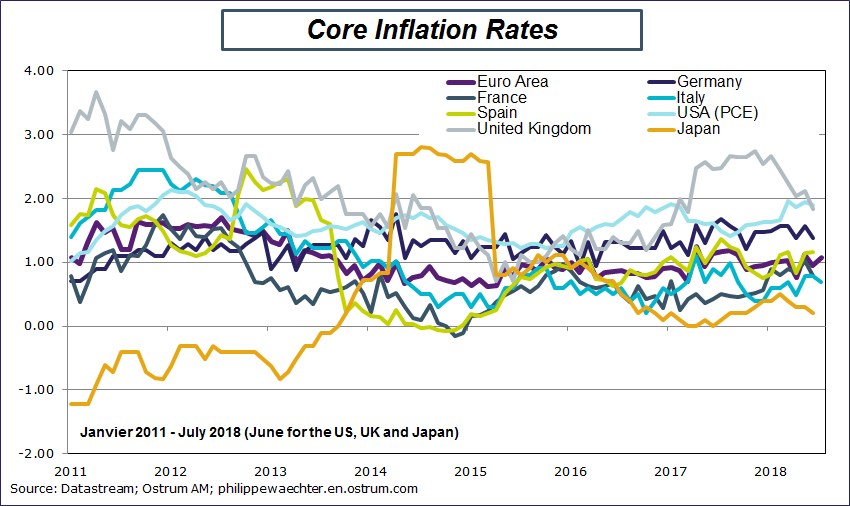

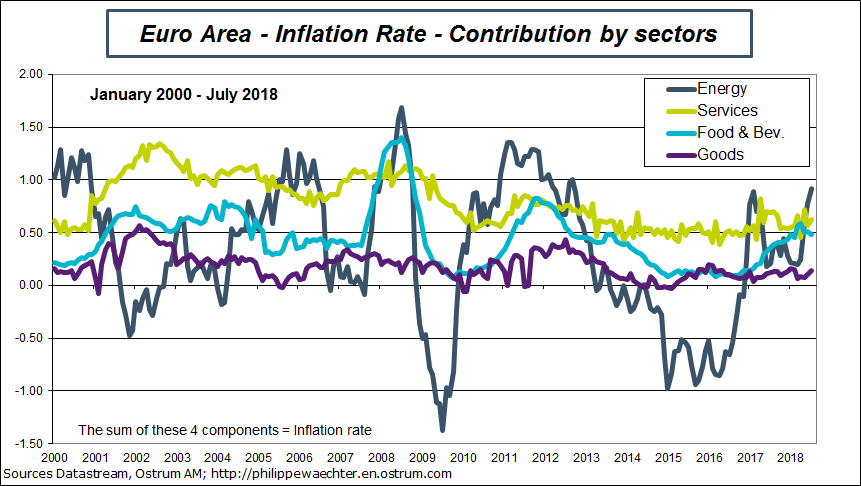

Some will say that the recent surge in the inflation rate was an important reason for the monetary policy restrictive bias. In the Euro Area, the core inflation rate is at 1.1% in July, in the UK it is at 1.8% in June, at 1.9% in the US in June and 0.2% in Japan. The recent acceleration in the inflation rate is due to the oil price. In other words, the rule for monetary policy is that a transitory phenomena mustn’t change the monetary strategy. If the oil price remains between 70 and 75 USD during the second part of this year, then the energy contribution to the inflation rate will decrease.

We perceive the current restrictive monetary bias as mimicking what was done in April and July 2011 in the Euro Area. The higher inflation rate triggered higher ECB rates. It was not necessary as this acceleration was transitory. But it has had an important contribution to the Euro Area recession that started during summer 2011.

We are not yet in a “new normal” environment and therefore it is necessary to be attentive to all the developments seen at the macroeconomic level and that have changed the global adjustment process.

The Global Growth is Faltering

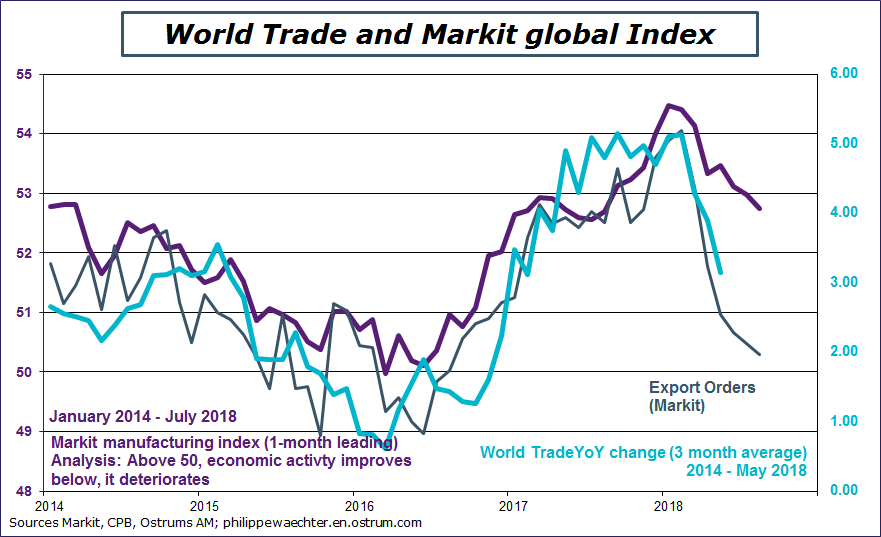

The global growth is pointing to a lower momentum. The world trade growth is now close to 3%, it was above 5% at the end of 2017 and the Markit world index for the manufacturing sector is now below 53 versus a peak at 54.5 last January. The graph below shows the turning point of the global economic activity.

The restrictive monetary policy bias

It is at this moment that central bankers have decided to change their mind and to adopt a tighter bias on their monetary policy or to start the tightening of their strategy.

We can understand higher rates in the US. I have explained here that the change in the US monetary policy was the best response to the White House stimulus through the fiscal policy.

But elsewhere, there is a kind of non sense to announce now a change in the monetary policy stance. The risk is to be pro-cyclical and to amplify the current downward trend seen on the global activity.

The Bank of England has announced a 25bp hike today with a rate at 0.75%. The Bank of Japan may allow a 20bp corridor for the 10 year rate around the target at 0%. The Bank of Canada has already started to lift its interest rates. The ECB has just said it will stop its quantitative easing operation at the end of this year and may increase its rate after Summer 2019.

The graph below shows the central banks turnaround.

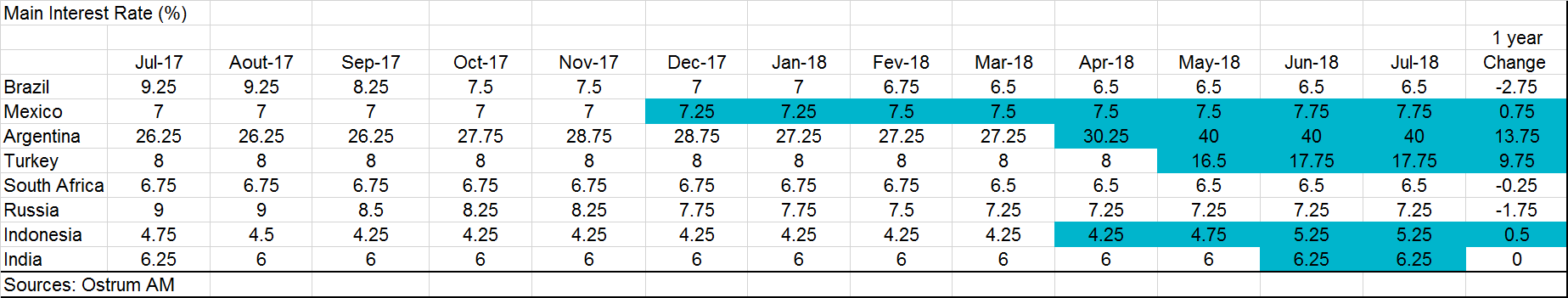

There is also a movement on emerging market side. It’s usually a response to the US tighter strategy.

Low core inflation rates

As mentioned above, core inflation rates are below the 2% central banks’ target

In the Euro Area, the surge in the inflation rate is linked to a very strong contribution from the energy sector. This contribution will be lower in coming months if the oil price remains between 70 and 75 USD. The difference with prices observed in 2017 will diminish in the second part of this year and the surge in the inflation rate will be transitory.

The UK situation

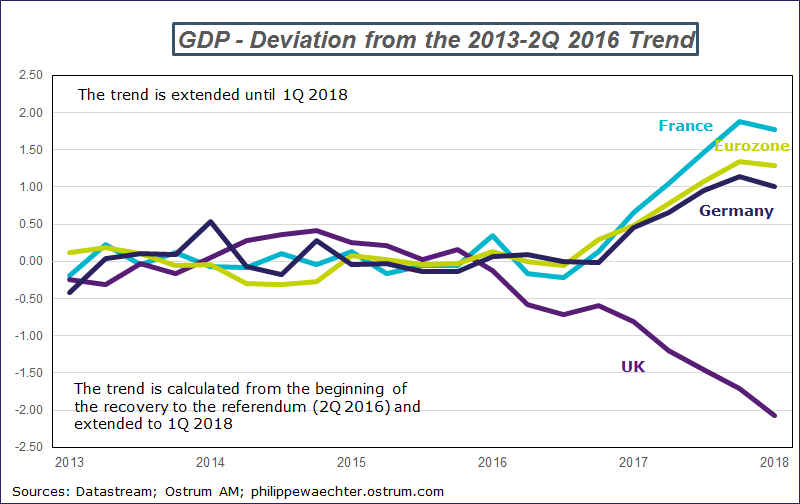

The graph shows that recent trend in the UK economic activity has been weak. The contagion effect of the European stronger growth has been very limited. The domestic market has been weak.

With this graph in mind, the BoE strategy of higher rates must be under scrutiny

Philippe Waechter's blog My french blog